All Categories

Featured

Table of Contents

The former is normally sent yearly, in December, while the last is recognized and paid when AcreTrader offers the property and the is dissolved. The system has a limited variety of brand-new offerings to pick from. Nonetheless, prospective detectives must note that AcreTrader has an extensive underwriting and due persistance procedure for residential or commercial properties offered on the system.

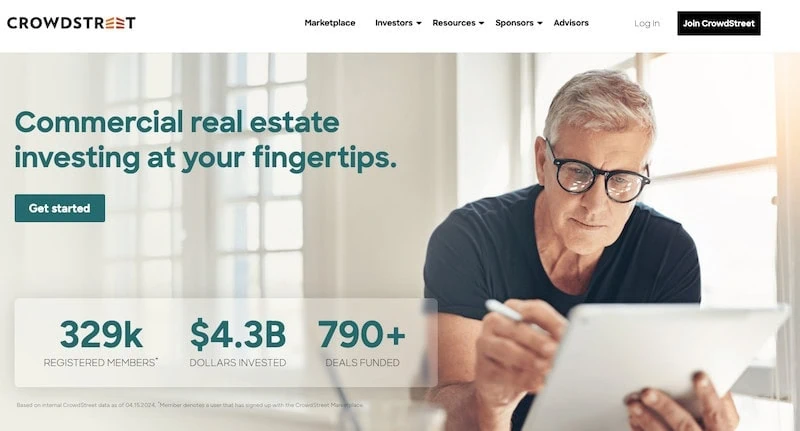

Investors can see for more information concerning the platform, view both current and previous offerings, and register for the service - Passive Real Estate Income for Accredited Investors. CrowdStreet $25,000 Accredited Investors Only is an actual estate financial investment system available solely to certified financiers wanting to buy industrial realty for long periods. The illiquid financial investments have carried out well, yet they need you to commit money for a few years, making you leave your money spent in these investments

The system caters to certified investors, whereas systems that enable non-accredited investors have low minimal financial investment requirements. Depending on the sort of job selected, you may be receiving a return immediately through quarterly dividends on the business service homes. You may also choose a job that takes a few years to offer you with money.

According to court papers, millions of bucks ended up in accounts owned by Nightingale Residence, which CrowdStreet partnered with on the affected realty transactions. CrowdStreet signaled regulators and generated an independent manager to establish just how the funds went missing out on (Residential Real Estate for Accredited Investors). We are checking this creating tale and might upgrade our recommendations depending on the result

Fundrise itself states that "the shares you possess are intended to be held long-term." You can sustain a fine for offering any type of eREIT and eFund shares held for much less than 5 years. You can not pick and pick what you sellFundrise's "first in first out" system suggests that when you liquidate, the first shares sold will be those you've held the lengthiest.

The business offers two private REITs for non-accredited capitalists and exclusive placements (exclusive property investments in between 2 or even more events) for approved financiers. Suppose you want to join personal positioning possibilities via. Because instance, you can choose to invest through fractional possession in a specific property or team of homes.

How do I apply for Accredited Investor Property Portfolios?

This fund purchases business property financial investment alternatives like office complex and retail space and residential genuine estate financial investment alternatives like multifamily residential properties. A more balanced technique in between earnings and growth, this REIT provides the capability to gain passive income at a reduced annualized rate than the regular monthly returns from The Revenue REIT, yet with an eye towards resources appreciation.

Masterworks' experienced art enthusiasts especially pick paints they believe will certainly have the greatest recognition prices and least expensive danger. This is a terrific option for individuals who want to invest in art, yet do not understand how to locate exclusive purchasers on their very own, don't have the funds to acquire these costly artworks, or aren't sure exactly how to save them effectively.

If you're enthusiastic about art and looking for a long-lasting financial investment, you might be able to utilize on blue-chip paints appreciating. DepositPhotos Bush funds are actively managed investment vehicles with managers that use various spending strategies.

What is the best way to compare Accredited Investor Real Estate Platforms options?

For these exotic financial investment decisions planned to generate returns more than the stock exchange, they tend to charge high charges. Such fee models include a percentage of assets under monitoring and revenues made throughout the year. One popular rates model is called the "2 and 20 version", where capitalists pay 2% of possessions under monitoring and 20% of all annual revenues.

Its top quality can improve gradually. Supply and demand job in your support, too, as a good vintage will gradually disappear in time to normal consumption. As an outcome, great glass of wines can deliver long-term, stable growth (Real Estate Investment Funds for Accredited Investors). It additionally does not correlate highly with the economic situation, so it can serve as a bush versus inflation and financial recessions.

If you intend to make cash from white wine, it requires to be of high top quality, ideally unusual, and stored in optimum conditions. Unless you already have large wine knowledge and a professional storage space setup, I advise making use of. Vinovest guarantees a glass of wine credibility, shops it for you, and ships it to buyers when they prepare to sell.

How do I apply for Accredited Investor Real Estate Deals?

These chances for certified financiers usually come with personal placements. These kinds of monetary setups entail prospective dangers not seen in conventional investments. Consequently, authorities desire to guarantee a recognized financier has the financial resources and refinement to comprehend these risky endeavors before continuing. While the accredited investor definition lately changedfrom one which usually indicated high-net-worth/high-income individuals to now one which focuses on financier experience and knowledgeit normally alters more in the direction of investors with funds and knowledge.

These tests for financial sources consist of having an accumulation of over $1,000,000 and gaining over $200,000 in each of the two latest years or joint income keeping that individual's spouse over $300,000 in each of those years with a reasonable expectation of reaching the exact same earnings level in the present year.

It would assist if you also held various other considerations like portfolio diversification and liquidity. To assist with this decision-making procedure, we've created the checklist of investment opportunities for accredited financiers that may be right for you. Of note, conventional financial investments like supplies and bonds can still provide wonderful. As a certified financier, you can buy every little thing a non-accredited capitalist can get.

What does Accredited Investor Real Estate Partnerships entail?

Most of the assets available to an accredited capitalist fall under (or "Reg D" for brief) under the Securities Act of 1933. This supplies a number of exceptions from the registration needs, permitting companies to supply and sell their protections without registering them with the SEC. As stated over, this can indicate a selection of personal positionings and other investments: Investments offered straight to financiers safeguarded by a firm's assets.

While comparable to common funds in that they pool investors' money together to acquire a typical basket of properties, these skillfully taken care of funds don't need a day-to-day reporting of internet asset value (NAV) and just allow designated durations (or periods) to transact (Commercial Real Estate for Accredited Investors). The thinking is that fund managers have a lot more flexibility when making financial investment choices as they have much more certainty they will have resources offered to the investment business

Certified financiers commit resources to a hedge fund and enable them to utilize various financial investment methods for their money. Usually your earnings level needs to be elevated, or you require a high internet well worth to add money to a hedge fund. Exclusive equity funds purchase companies and do not have this company openly readily available to various other investors.

Private Real Estate Deals For Accredited Investors

This implies a capitalist expects to gain greater returns than those offered through conventional safeties like supplies, shared funds, or exchange-traded funds since they shed access to their money up until the investment matures. Coming to be a recognized investor allows you to purchase even more possessions than the spending public. Numerous companies particularly develop unique investment swimming pools catering to approved investors, as this entails less regulative problem and problem with registering securities with the appropriate regulatory authorities.

Latest Posts

Real Property Tax Forfeiture And Foreclosure

Tax Delinquent Properties Near Me

What Is A Delinquent Tax Sale