All Categories

Featured

In 2020, an approximated 13.6 million united state houses are accredited investors. These families control enormous wide range, approximated at over $73 trillion, which represents over 76% of all private riches in the U.S. These investors take part in investment possibilities generally not available to non-accredited capitalists, such as investments secretive firms and offerings by certain hedge funds, exclusive equity funds, and financial backing funds, which permit them to expand their wealth.

Read on for details regarding the newest recognized capitalist revisions. Financial institutions normally money the majority, yet rarely all, of the capital needed of any type of acquisition.

There are mainly 2 policies that enable issuers of protections to offer unlimited amounts of safety and securities to investors. accredited investor investment opportunities. Among them is Regulation 506(b) of Guideline D, which permits a company to sell securities to endless certified financiers and approximately 35 Innovative Capitalists just if the offering is NOT made with general solicitation and general marketing

The freshly adopted amendments for the initial time accredit individual financiers based on monetary class needs. The amendments to the certified financier interpretation in Regulation 501(a): include as certified financiers any kind of trust fund, with total assets a lot more than $5 million, not developed especially to acquire the subject securities, whose acquisition is guided by an advanced person, or include as accredited financiers any type of entity in which all the equity proprietors are certified financiers.

And since you understand what it indicates, see 4 Property Advertising strategies to attract accredited investors. Internet Site DQYDJ PostInvestor.govSEC Proposed amendments to meaning of Accredited InvestorSEC updates the Accredited Investor Meaning. Under the federal safety and securities legislations, a business might not use or offer securities to financiers without registration with the SEC. There are a number of enrollment exemptions that inevitably increase the universe of prospective financiers. Several exceptions need that the investment offering be made only to persons who are approved capitalists.

Additionally, recognized investors usually receive much more favorable terms and higher possible returns than what is readily available to the public. This is because private placements and hedge funds are not needed to comply with the same governing demands as public offerings, enabling even more adaptability in regards to financial investment approaches and possible returns.

Real Estate Investing Non Accredited

One factor these safety and security offerings are restricted to accredited capitalists is to guarantee that all getting involved investors are economically advanced and able to fend for themselves or maintain the danger of loss, therefore providing unneeded the securities that come from an authorized offering.

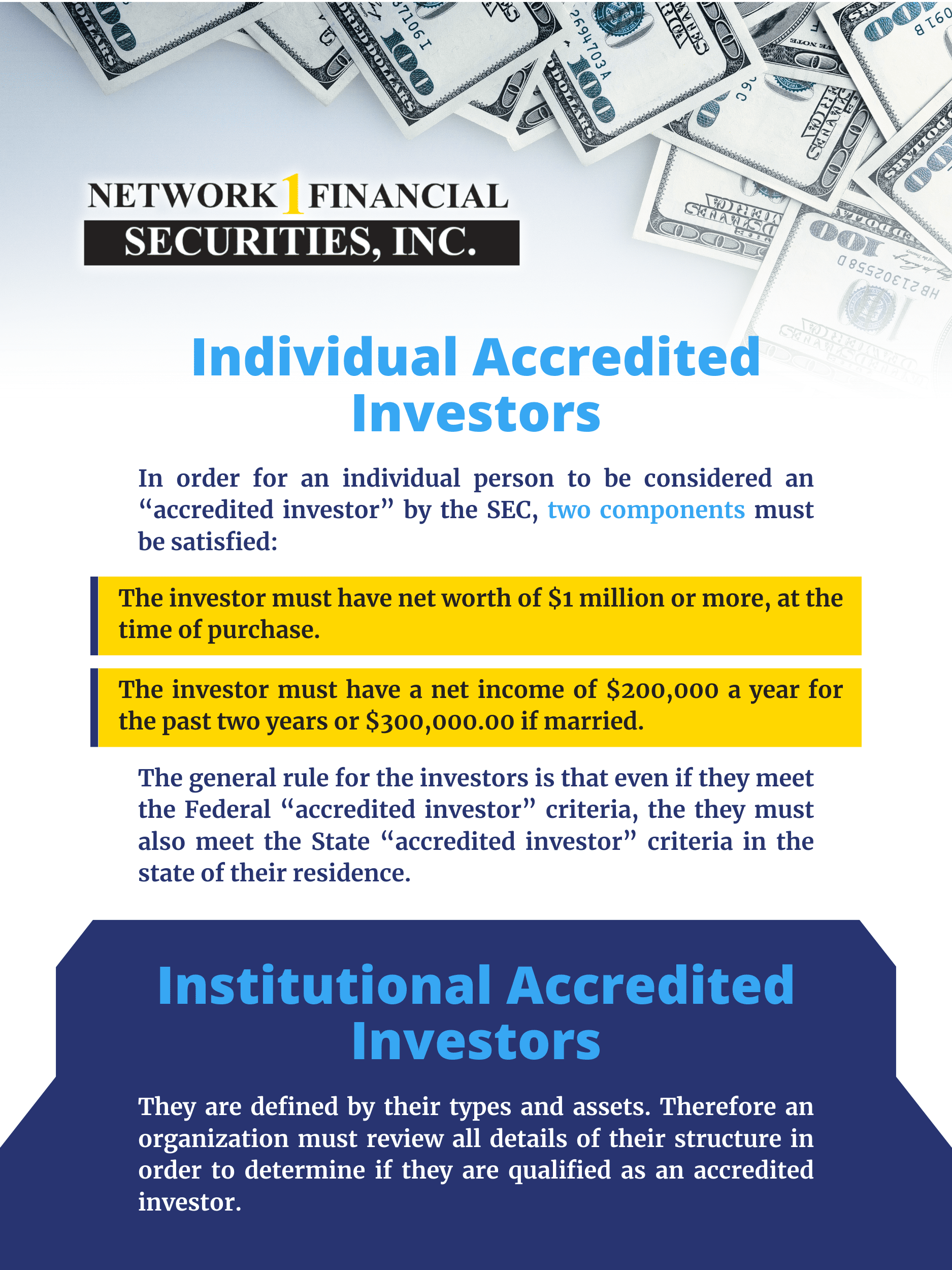

The internet worth examination is reasonably simple. Either you have a million bucks, or you do not. However, on the income test, the person should please the limits for the three years constantly either alone or with a partner, and can not, for instance, please one year based on specific income and the next two years based on joint earnings with a partner.

Latest Posts

Real Property Tax Forfeiture And Foreclosure

Tax Delinquent Properties Near Me

What Is A Delinquent Tax Sale